north dakota sales tax online

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. While it is highly recommended that you file online using the North Dakota Taxpayer Access Point TAP website it is possible to file your.

About The North Dakota Office Of State Tax Commissioner

Local Jurisdiction Sales and Use Taxes.

. E-Filing Free Filing. Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. North Dakota will be collecting sales taxes from online retailers in the wake of todays ruling by the US.

Supreme Court overturning a 1992 case that prohibited such collections. 800 524-1620 North Dakota State Sales Tax Online. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Thank you for selecting the State of North Dakota as the home for your new business. Groceries are exempt from the North Dakota sales tax. County parcel tax information can be accessed by clicking on the County of your choosing.

Get Your North Dakota Sales Use Tax Permit Online. 31 rows The state sales tax rate in North Dakota is 5000. Call Sales Tax Helper LLC Today.

With local taxes the. Register once for secure access to State services. Call Sales Tax Helper LLC Today.

File the North Dakota Sales Tax Return You will do this with the North Dakota. No credit card required. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now. Only Pay for What You Need. The governing body of any city or county may by ordinance impose a city or county.

One North Dakota Login and password to access multiple ND Online Services. 2022 North Dakota state use tax. This free and secure.

The North Dakota use tax is a special excise tax assessed on property purchased for use in North. Weve Helped Clients Ranging from Mom-and-Pop Shops to Global Publicly Traded Companies. State Sales and Use Tax Rate.

Welcome to the North Dakota Property Tax Information Portal. Property Tax Information Portal. Weve Helped Clients Ranging from Mom-and-Pop Shops to Global Publicly Traded Companies.

Welcome To The New Business Registration Web Site. Unemployment Insurance Tax. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. The topics addressed within this site will assist you. Only Pay for What You Need.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Sales and Use Tax Rates Look Up. Sales Tax Rates in North Dakota.

Filing Your North Dakota Sales Tax Returns Offline. The ND use tax only applies to certain purchases. Counties and cities can charge.

North Dakota requires businesses to file sales tax returns and submit sales tax payments online. Ad A brand new low cost solution for small businesses is here - Returns For Small Business. The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well.

Returns for small business Free automated sales tax filing for small businesses for up to 60 days. An additional tax may be imposed on the rental of lodging and sales of prepared food and beverages. NORTH DAKOTA SALES TAX PERMIT APPLICATION.

Sales Tax Rate Information. Thursday June 23 2022 - 0900 am. You can easily acquire your North Dakota Sales Use Tax Permit online using the Taxpayer Access Point TAP website.

This allows you to file and pay both your federal and North Dakota. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

A Visual History Of Sales Tax Collection At Amazon Com Itep

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

How To Register For A Sales Tax Permit Taxjar

North Dakota Sales Tax Handbook 2022

Internet Sales Tax Definition Taxedu Tax Foundation

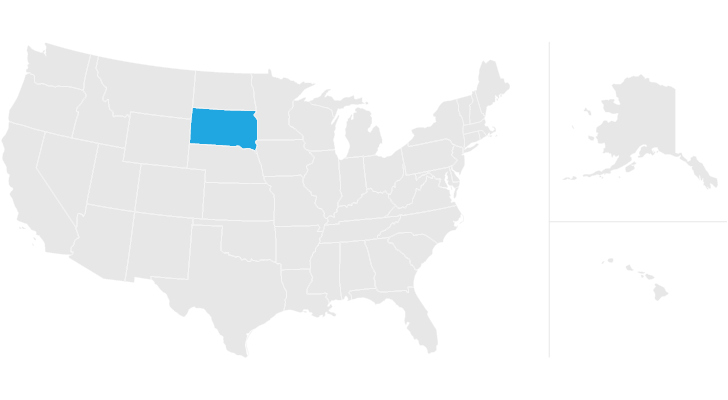

South Dakota Statute Of Limitations Personal Injury Malpractice And Wrongful Death Statutes Of Limitations In South Dakota

South Dakota S Marketplace Facilitator Sales Tax Law Explained Taxjar

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

Internet Sales Tax Definition Types And Examples Article

How To File Sales Tax In Each State Taxjar

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Income Tax Update Special Session 2021

South Dakota Estate Tax Everything You Need To Know Smartasset

Sales Tax By State Is Saas Taxable Taxjar

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)