mississippi state income tax calculator

Total Tax Liability 880 John marries Mary who has taxable income of 20000. Ad ETA Form 790 More Fillable Forms Register and Subscribe Now.

Income Tax Formula Excel University

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

. Click on the income amounts below to see how much tax you may pay based on the filing status and state entered above. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Federal or IRS Taxes Are Listed.

5000 X 4 200 13000 X 5 650. Mississippi Income Tax Calculator 2021. Box 23050 Jackson MS 39225-3050.

Click on the income amounts below to see how much tax you may pay based on the filing status and state entered above. After a few seconds you will be provided with a full breakdown of the tax you are paying. Mississippi Tax Brackets for Tax Year 2021.

196000 196500. The state income tax system in Mississippi has 3 different. Mississippi Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

To estimate your tax return for 202223 please select the 2022 tax year. If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results. Detailed Mississippi state income tax rates and brackets are available on this page.

Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. All other income tax returns P.

Information on Available Tax Credits. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. His tax liability will be.

4000 X 0 0 1000 X 3 30. Figure out your filing status. No cities within Mississippi charge any additional municipal income taxes so its pretty simple to calculate this part of your employees withholding.

See What Credits and Deductions Apply to You. Employees who earn more than 10000 a year will hit the top bracket. Mississippi Income Tax Calculator 2021.

The Mississippi State Tax Calculator MSS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Mississippis state income tax is fairly straightforward. John is single and has taxable income of 23000.

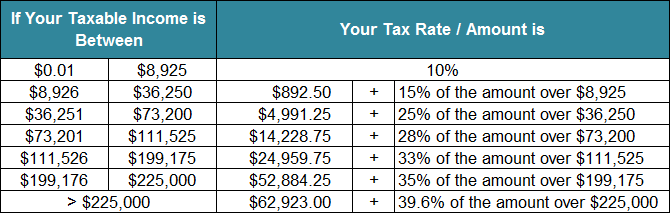

These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other financial data. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. Ad Enter Your Tax Information.

Calculate your total income taxes. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Details of the personal income tax rates used in the 2022 Mississippi State Calculator are published below the.

Using our Mississippi Salary Tax Calculator. 127500 128000. This income tax calculator can help estimate your average income tax rate and your take home pay.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. How many income tax brackets are there in Mississippi. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Calculating your Mississippi state income tax is similar to the steps we listed on our Federal paycheck calculator. Any income over 10000 would be taxes at the highest rate of 5.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. You can quickly estimate your Mississippi State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses. If you make 72500 a year living in the region of Mississippi USA you will be taxed 12147.

The Mississippi Income Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. Federal Mississippi taxes FICA and state payroll tax. Your average tax rate is 1233 and your marginal tax rate.

The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022. Your average tax rate is 1198 and your marginal tax rate. There are just three income tax brackets and the tax rates range from 0 to 5.

Updated for 2022 tax year. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

Income Tax Formula Excel University

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Income Tax Formula Excel University

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Mississippi Tax Rate H R Block

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Income Tax Calculator Estimate Your Refund In Seconds For Free

Paycheck Calculator Take Home Pay Calculator

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus